Liability Insurance

Just in Case!

Your business matters and so does your peace of mind.

The insurance you need depends on your business

If you employ staff then you will need Employers’ Liability cover

If you are in contact with members of the public you will need Public and Products Liability cover

On many occasions you will want a Combined Liability policy that will cover you for all of the above and more

You may also want to cover some or all of the following...

- BUILDINGS

- CONTENTS

- STOCK & EQUIPMENT

- MONEY

- BUSINESS INTERRUPTION

- OVERNIGHT TOOLS

- TERRORISM

- GOODS IN TRANSIT

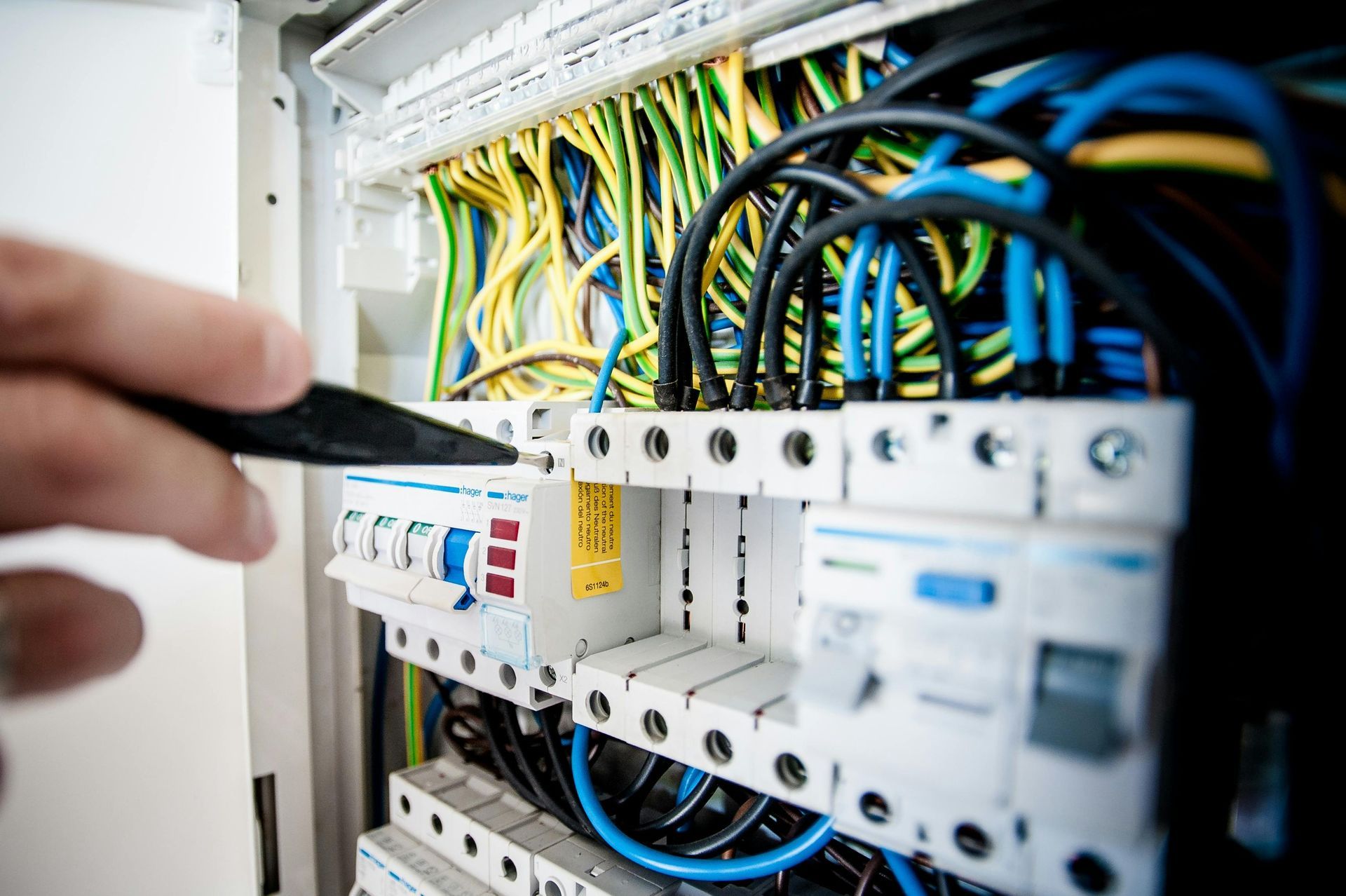

PUBLIC LIABILITY

Public liability insurance covers the cost of claims made by members of the public for incidents that occur in connection with your business activities.

Most Public Liability policies cover you for incidents that occur on your business premises, but will also cover incidents that take place off-site, at events or activities organised or attended by your company or on site visits.

Public liability offers cover in the event of accidental bodily injury such as trips and slips as well as damage caused to property.

EMPLOYERS LIABILITY

At Just In Case Insurance, we understand that safeguarding your business starts with protecting your most valuable asset—your employees.

Our Employers Liability insurance ensures you're covered in the event of workplace injuries or illnesses, offering peace of mind for both you and your team.

We're here to help you secure the right coverage tailored to your unique needs. Let us handle the complexities, so you can focus on what you do best!

PRODUCTS LIABILITY

Most Public liability insurance policies will also include Product Liability Insurance which is designed to cover the products either sold or manufactured by a company.

Any product sold or even given away must be fit for purpose and you will be legally responsible for any damages or injury caused from a product you supply if it goes wrong.

In certain situations you may be liable even if you haven’t actually manufactured the product.

You can look to combine all of the above covers under a package policy generally known as Combined Liability.

COMBINED LIABILITY

Combined Liability will normally look to package your Public/Products and Employers Liability cover under one premium and will be based on a number of factors including:

- The nature of your business

- Your annual turnover

- The number of people you employ

- Your insurance claims history

Choosing the right insurance

can be a stressful enough.

Thats why we make buying your

Tradesperson Insurance

as easy as possible!

Just In Case!

"to be prepared for

something that may happen"